RFM segmentation

RFM analysis is the analysis of a company's customers to segment them by business value. RFM analysis is widely used in marketing, direct marketing and especially in retail and service industries.

The analysis uses 3 dimensions:

- Recency — how long ago was the customer's last purchase? The less time that has passed since the customer's last activity, the more likely they are to repeat the action.

- Frequency — how often has the customer made a purchase? The more purchases the customer makes, the more likely they are to repeat it in the future.

- Monetary (sales) — how much money did the customer spend? The more money the customer spends, the more likely they are to repeat the purchase.

It is assumed that a customer who has made recent purchases, shows higher activity and spends more money on purchases, will continue to show active consumer behavior in the future.

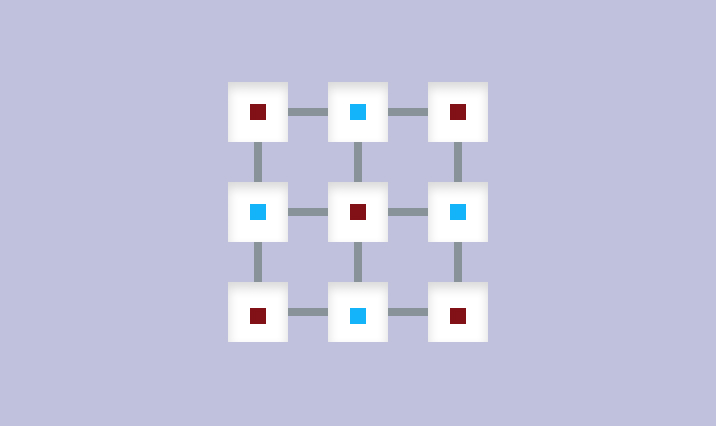

The history of customer purchases or product sales is presented in the form of a table or RFM matrix with three columns: Recency, Frequency, and Monetary value. Each column is divided into categories.

For example, Recency can be divided into intervals of 1 - 30 days (current), 31 - 60 days (recent), 61 - 90 days (long ago). Frequency of purchases can be categorized into frequent (more than 10 per month), infrequent (3 - 10 per month), and one-time (less than 3 times per month). Sales can be categorized into high, medium, and low. Then an RFM matrix of the following form can be compiled:

It is easy to see that the most "promising" customers will be in the upper left corner of the table, in the highlighted segment (contains customers who make frequent, recent or recent purchases, spending medium or large amounts). The least "promising" will be in the lowest highlighted segment (one-time purchases made recently or recently for small or medium amounts).

Depending on the type of analysis, other representations of the RFM matrix may be used. For example, instead of using 3 categories for each dimension, resulting in 27 segments, 5 categories are used, resulting in 125 segments. In this case, the analysis results are more detailed.

Sometimes segments of the matrix are given a score between 1 (the "least attractive") and 5 (the "most attractive" segment). In this case, the "best" segment would be labeled 5R-5F-5M and the "worst" segment would be labeled 1R-1F-1M. Then the customers that fall into the 3R-3F-3M segment can be interpreted as averagely attractive.

The advantage of the method is simplicity (no special statistical software is needed) and the results are easy to interpret. When used in direct marketing, the application of RFM analysis can increase the number of responses to promotions.

There are several modifications of RFM analysis:

-

RFD — Recency, Frequency, Duration - a modified version of RFM analysis for studying consumer behavior of business products targeted at viewers, readers, Internet surfers (e.g., dwell time in an online movie theater).

-

RFE — Recency, Frequency, Engagement is an extended version of RFD analysis that evaluates customer engagement with a business product. In addition to duration, it uses the number of web pages visited, the number of hyperlink clicks, and other actions that show active use of the business product. It is assumed that the most active customers are more likely to respond to marketing actions.

-

RFM-I — Recency, Frequency, Monetary-Interactions - is a version of RFM analysis to consider the recency and frequency of marketing interactions with a customer, e.g., to study the possible deterrent effect of frequent promotional activities (when overly intrusive advertising repels a customer).